Our Early Warning service provides…

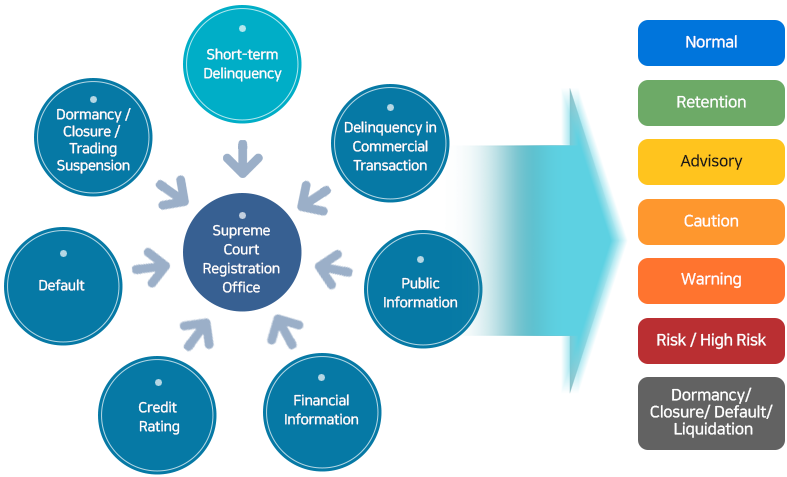

- Direct monitoring service of short-term delinquency, public information, trading suspension, etc. - Daily updates of accounts' credit-standings categorized in 11 grades. - High bankruptcy prediction based on the statistical analysis of monitoring factors and EW grades.

What is Early Warning?

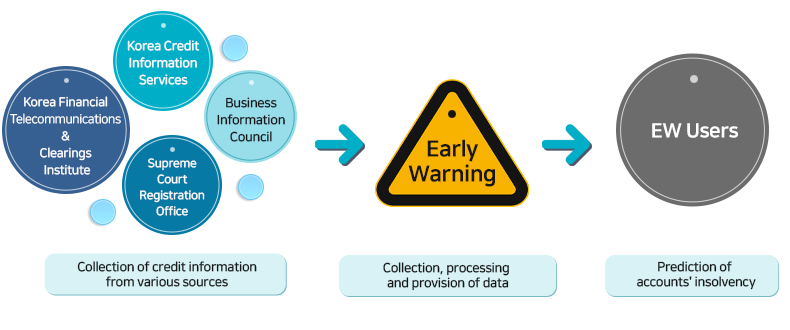

Early Warning is monitoring service on accounts to provide information that allows a user to predict its account’s possibility of insolvency based on credit information monitoring. Early Warning ensures effective and systematic credit management on accounts through monitoring of data such as short-term delinquency, public information, trading suspension, etc., that are closely related to accounts' insolvency via statistical analysis of bankrupt companies.

After registering its accounts on Early Warning, a user will receive a notification email on a daily basis about changes that have occurred in its accounts. The detailed information can also be found online.

| Service Type | The Number of Accounts | Monthly Fee |

|---|---|---|

| EW-2000 | ~ 2,000 | US$2,000 |

| EW-3000 | 2,001~ 3,000 | US$2,400 |

| EW-4000 | 3,001~ 4,000 | US$2,850 |

| EW-5000 | 4,001~ 5,000 | US$3,200 |

| EW-6000 | 5,001~ 6,000 | US$3,500 |

| EW-7000 | 6,001~ 7,000 | US$3,750 |

| EW-8000 | 7,001~ 8,000 | US$3,950 |

| EW-9000 | 8,001~ 9,000 | US$4,100 |

| EW-10000 | ~ 10,000 | US$4,200 |

Cost can be adjusted depending on your quantity. For further information, please contact info@kodata.co.kr.

Data Loading.....